The latest gross domestic product (GDP) statistics show the economy unexpectedly grew in November easing fears that the UK has already slipped into recession.

Data released by the Office for National Statistics (ONS) revealed that the UK economy expanded by 0.1% in November. This figure was higher than any forecast submitted to a Reuters poll of economists with the consensus prediction suggesting the economy would shrink by 0.2% across the month.

ONS said much of the growth was linked to the football World Cup, with pubs and restaurants benefiting as people went out to watch the games. The figures were also boosted by an increase in demand for services in the tech sector.

November’s better than anticipated data makes it more likely that the UK managed to avoid entering recession during the final half of last year. Economists are now typically forecasting that GDP will have flatlined during the fourth quarter of 2022 and thereby dodged the technical definition of a recession.

However, the consensus view does still suggest the UK is likely to record two negative quarters of growth during the first half of this year as consumers continue to struggle with rising food and energy bills, and ongoing industrial action acts as a drag on growth. A recent Reuters poll puts a 75% chance on the UK slipping into recession this year, although any downturn is expected to be relatively shallow.

This view was largely supported by data from the recently released S&P Global Purchasing Managers’ Index. While the closely monitored survey recorded a sixth consecutive monthly decline in UK business activity during January, the scale of the downturn signalled by the data remains relatively modest by historic standards. There was also some positive news from forward-looking indicators, with a jump in business optimism for the year ahead.

Inflation expected to fall rapidly

Bank of England (BoE) Governor Andrew Bailey has suggested that a recent easing in the headline rate of inflation could be a sign that “a corner has been turned.”

Data released last month by ONS showed that the Consumer Prices Index (CPI) annual rate – which compares prices in the current month with the same period a year earlier – fell to 10.5% in December. This was the second successive monthly decline since inflation hit a 41-year high of 11.1% in October.

ONS said that easing price pressures for motor fuels and clothing had pushed down December’s headline rate. Dips in these sectors, however, were partially offset by a further sharp rise in the cost of food and non-alcoholic drinks, while restaurant and hotel prices also increased significantly.

Despite the latest fall, the annual rate of CPI inflation clearly remains well above the BoE’s 2% target level. Indeed, when releasing the data, ONS Chief Economist Grant Fitzner pointed out that, “Although we’ve seen a second consecutive easing, it is a fairly modest fall and inflation is still at a very high level with overall prices rising strongly.”

Economists and policymakers, however, are increasingly predicting that inflation has now peaked. Last month, for example, the BoE Governor said inflation looks set to fall “quite rapidly” from the spring as energy prices decrease and that the Bank was more optimistic inflation could be on an “easier path.”

Other data published last month also points to easing inflationary pressures. The latest producer prices data from ONS, for instance, unexpectedly revealed a drop in manufacturers’ input and output prices in December, with both recording the largest monthly fall since April 2020. In addition, a CBI survey found that British factories reported the slowest growth in costs for almost two years during the three months to January.

Markets

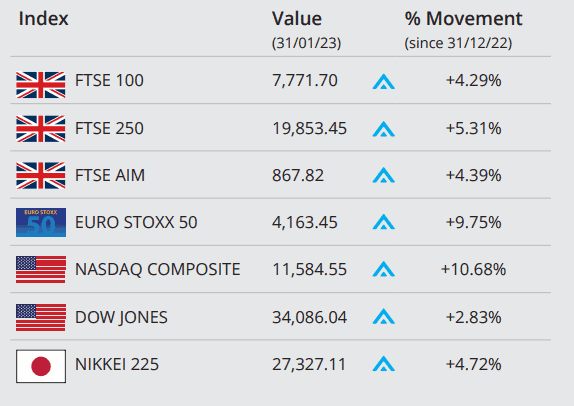

Major global indices closed January in positive territory. As the month drew to a close, investors were looking ahead to the Federal Reserve and Bank of England monetary policy decisions in early February.

In the UK, the FTSE 100 ended January on 7,771.70, a gain of 4.29% in the month. The domestically focused FTSE 250, more closely correlated to the UK economy, closed the month up 5.31% on 19,853.45, while the FTSE AIM closed January on 867.82, a monthly gain of 4.39%. UK markets were impacted at month end after the International Monetary Fund’s forecast detailed lagging growth versus G7 counterparts.

Across the pond, the Dow Jones index closed January up 2.83% on 34,086.04, while the NASDAQ closed the month up 10.68% on 11,584.55, amid a flurry of corporate earnings and the imminent Fed policy meeting. On the continent, the Euro Stoxx 50 closed the month on 4,163.45, registering a gain of 9.75%. In Japan, the Nikkei 225 closed January up 4.72%, on 27,327.11.

On the foreign exchanges, the euro closed the month at €1.13 against sterling. The US dollar closed at $1.23 against sterling and at $1.08 against the euro.

Gold closed the month trading at around $1,923 a troy ounce, a monthly gain of around 6.0%. The gold price has risen as demand for the precious metal holds firm in the face of economic uncertainty. Brent crude closed the month trading at around $85 a barrel, a small monthly gain of 0.77%. The next OPEC+ (Organization of the Petroleum Exporting Countries and allies) producer meeting in early February will provide clarity on the trajectory of global supplies.

Pay growth picks up pace

While the latest earnings statistics revealed that wages are now rising at their fastest rate in over 20 years, the data also showed that pay growth is still failing to keep up with the rise in prices.

According to figures released last month by ONS, average weekly earnings excluding bonuses rose at an annual rate of 6.4% in the three months to November. This figure represents the strongest growth in regular pay since records began in 2001, excluding the coronavirus period when the data was distorted by workers returning from furlough.

However, despite this historically high level of nominal earnings growth, the real value of people’s wages continues to fall, with regular pay levels actually down by 2.6% when adjusted for inflation. Although this decline is slightly smaller than the 3.0% fall in real regular pay reported in Q2 2022, it still represents one of the largest real declines in wages ever recorded.

The latest data also highlighted the wide disparity in pay growth for private sector and public sector workers. In the three months to November, private-sector regular pay levels rose by an average annual rate of 7.2% compared with 3.3% across the public sector.

Retail sales suffer December decline

Official data shows that sales volumes fell in December, capping a difficult year for the retail sector, while more recent survey evidence suggests conditions remain challenging.

The latest ONS retail sales statistics revealed that total sales volumes in December unexpectedly fell by 1.0% from the previous month and by a record 5.8% compared with December 2021. Across the whole year, sales volumes declined by 3.0% compared with 2021, the worst full-year performance since records began in 1997.

While rising prices did see many retailers report relatively strong festive sales figures in monetary value terms, the official data shows that high inflation has resulted in shoppers effectively getting less for their money. ONS also noted that feedback from retailers suggested consumers were “cutting back on spending because of increased prices and affordability concerns.”

Survey data suggests sales volumes continued to slide in the new year, with the CBI’s latest Distributive Trades Survey showing a net balance of retailers reporting year-on-year sales growth falling to -23% in January. CBI Principal Economist Martin Sartorius said, “Retailers began the new year with a return to falling sales volumes, as the sector continues to face the twin headwinds of rising costs and squeezed household incomes.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.