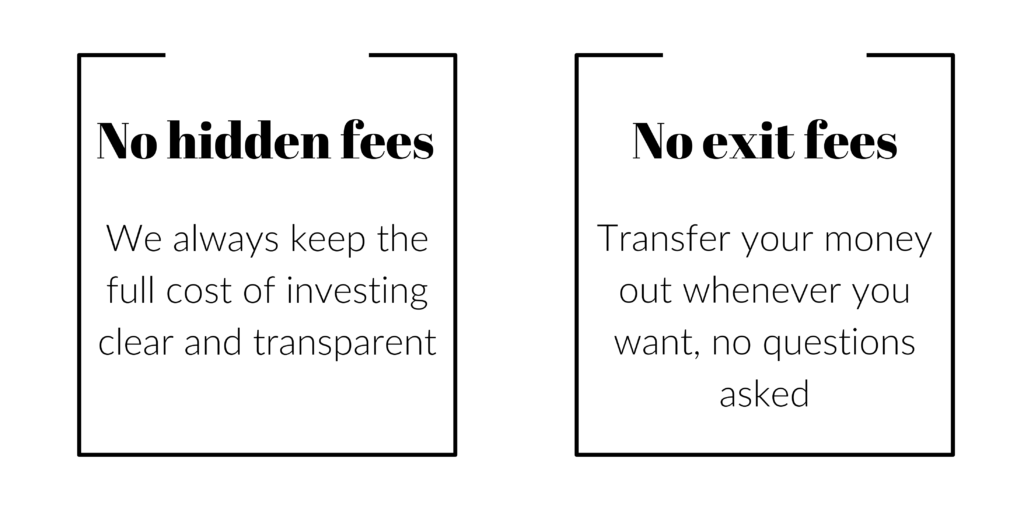

Simple Fee Structure and Complete Transparency

A Simple Fee Structure With No Hidden Costs

Initial Meeting Costs

We think we can help 99% of people we meet to become more financially savvy, so we absorb the costs of the first meeting we have.

In this initial chat, we aim to impress you with some unique planning ideas, add more value to your existing plans or get some money back in your pocket from tax planning. If we can’t do any of that, we will shake hands, thank you for the opportunity and there are no fees for you.

We typically save clients an average of £11,000 of tax per year, although this obviously is not guaranteed with each and every client, each and every year.

Plan Maintenance and Advice

If we impress you and you decide to work with us to improve your current finances, we can be paid in one of three ways: fees directly from a plan (common), a commission from a mortgage or protection provider (common), or as an hourly charge (uncommon). During the second meeting, we will walk you through all the likely charges and you can let us know if you want to proceed with us.

As an example, if you think we have good ideas and you wanted us to manage your pensions, we charge 0.75% of the funds we manage, so if you had £50,000, we would charge £375 per annum directly from pension. Pretty straightforward, right?

Exit Fees

Occasionally some products that we advise on will have exit fees (such as early repayment charges on a mortgage). We will outline all of these penalties to you as part of the setup so there aren’t any nasty surprises if your financial plans change in the future. The vast majority of plans do not have an exit fee, so if you feel the provider has done as much as they could and you want to work with someone else, there are no costs to leave